ev charger tax credit form

Federal EV Charging Tax Credit. Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year.

How To Claim An Electric Vehicle Tax Credit Enel X

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. If you purchased your EV more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to claim your credit. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit.

Must be purchased and installed by December 31 2021 and claim the credit on your federal tax return. Installation of specified electric vehicle supply equipment or direct current fast chargers or both in a covered multifamily dwelling or covered nonresidential building. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations.

Figured it out. IRS Form 8911 and it provides a tax credit of 30 up to 1000 of the purchase and installation cost of. 2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle.

Partnerships and S corporations report the above credits on line 8. The charging station must be purchased and installed. Federal EV Charger Incentives.

Starting on January 1 2020 MOR-EV will be extended to support qualifying battery electric vehicles BEVs and fuel cell electric vehicles FCEVs up to a 50000 final purchase price with a 2500 rebate. Qualified Plug-in Electric Drive Motor Vehicle Credit Personal use part Form 8936 Part III. Enter total alternative fuel vehicle refueling property credits from.

Beginning on January 1 2021. So after your Form 8936 credit is applied to tax any amount of tax remaining will be offset by your Residential Energy Credit. About Form 8911 Alternative Fuel Vehicle Refueling Property Credit.

A tax credit for an Electric Vehicle Charger is available only to business enterprises that are not retail and are engaged in manufacturing warehousing and distribution processing telecommunications tourism or research and development industries. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Make sure to keep receipts for the equipment and installation of your EV charger.

Electric vehicle chargers - 10 of the cost of the charger and its installation or 2500 whichever is less. And Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc box 13 code P. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience. This importantly covers both components on charging costs. The US Federal Tax Credit gives individuals 30 off a Home Electric Vehicle charging station plus installation costs.

Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The credit is the smaller of 30 or 1000.

Install costs can account for the majority of the total cost of installing EV charging especially for commercial installations. Tax credits are available for EV charger hardware and installation costs. This publication is intended to provide general information to our clients and friends.

Its subject to TMT whereas other credits like The EV car credit and Solar credits arent. 500 per Level 2 or higher electric vehicle supply equipment installed during the taxable year and. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive.

30 tax credit up to 1000 for residential and 30000 for commercial. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles Orange. You use form 8911 to apply for.

Any credit not attributable to. You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000. This video covers how to complete IRS Form 8911The federa.

Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc box 15 code P. Additionally plug-in hybrid electric vehicles PHEVS with an all-electric range of 25 miles or greater and with a final purchase price up. For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure.

You claim the credit on your Federal tax return by completing a form 8911 see the form here. Basically if you have enough credits for the year even if you still have tax liability and no AMT your TMT will dictate if you will get the EV Charger credit. For more information please contact your BNN tax advisor at 8002447444.

You can also review the guidance from the IRS at this site IRS Guidance 8911 or consult your tax advisor. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out Form 8936 along with Form 1040. The credit is computed and reported on IRS Form 8911.

A qualified taxpayer would be allowed a credit of. It covers 30 of the costs with a maximum 1000. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent.

Alternative Fuel Vehicle Refueling Property Credit Form 8911. Just buy and install by December 31 2021 then claim the credit on your federal tax return. The federal government offers a tax credit for EV charging stations known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs.

Residential Energy Credits Form 5695 Part I then. Grab IRS form 8911 or use our handy guide to get your credit.

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

About Electric Vehicle Charging Efficiency Maine

Rebates And Tax Credits For Electric Vehicle Charging Stations

Commercial Ev Charging Incentives In 2022 Revision Energy

Electric Vehicle Charger Installation

How To Choose The Right Ev Charger For You Forbes Wheels

Ev Charging Stations 101 Wright Hennepin

Juicebox 40 Amp Electric Vehicle Charging Station With Nema 20 Ft Cable Costco

Residential Charging Station Tax Credit Evocharge

Tax Credit For Electric Vehicle Chargers Enel X

Fuseproject Product Ge Wattstation Electric Car Charger Ev Charger Charger Car

Guide To Home Ev Charging Incentives In The United States Evolve

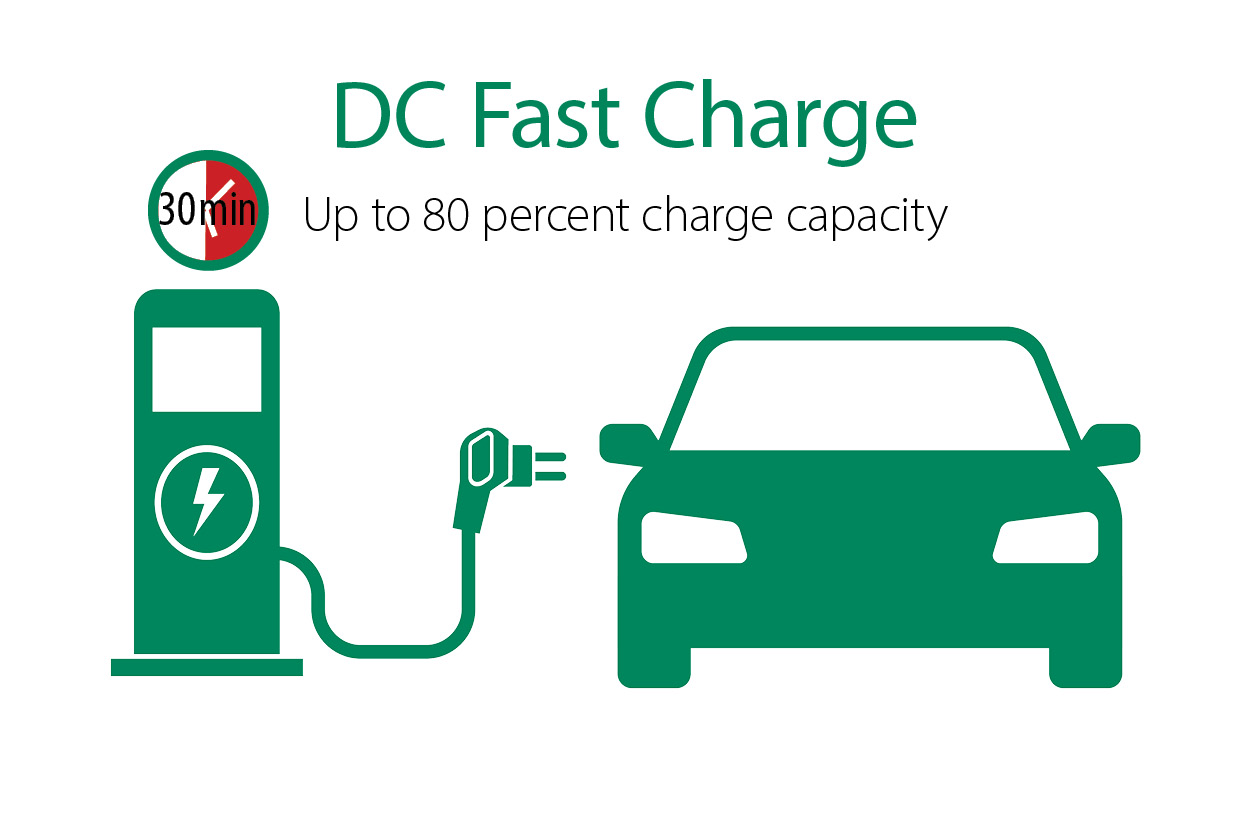

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Home Charging For E Mobility Designed By Kiska On Behance Station De Charge Electronics Projects Voiture Electrique

How To Claim Your Federal Tax Credit For Home Charging Chargepoint